EmpoweringDigitallyConnectedCommunities

Know more 5G Marketplace - Moments

Power of 5G lifestyle bundling with the ultimate B2B2X multi-experience platform

Learn More

Tecnotree AI-enabled Experiences

Strengthening Telco Products with AI-enabled Intelligent and Immersive Customer Experiences

Learn More

Customer Experience Management - Customer 360

Prioritizing customer experiences through real time insights

Learn More

Enterprise Experience Management - DEM

Accelerate digital transformation through enterprise personalization and automation

Learn More

Digital Acceleration – Surge

Continuous innovation, optimization, and deployment of revenue generating digital microservices

Learn More

5G Cloud Enabled Services - Edge

BSS enablers delivering monetization solutions for a seamless personalised experience

Learn More

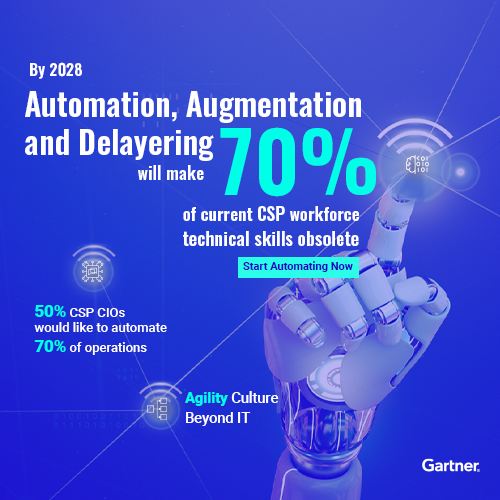

Automated Operations - Managed Services

Accelerate business agility with a dynamic set of BSS applications

Learn More

Value Added Service

Personalized and enhanced services for a seamless customer experience

Learn More

Mobile Financial Inclusion – Diwa

Advanced digital banking platform to automate financial products and solutions

Learn More

70+

80+%

990Million

90+

Who we work with

Bmobile is embarking on a BSS transformation program and we are delighted to entrust our BSS partner, Tecnotree, with the upgrade and transformation of our BSS platform. As Bmobile operates mobile networks in two Pacific countries, Papua New Guinea and the Solomon Islands, the transformation allows Bmobile to support both countries’ mobile operations with a single BSS platform enabling a reduction in operating costs.

-Athula Biyanwila

- Group CEO, Bmobile (PNG & SI)

Movistar Ecuador has become a leader in the deployment of digital channels for customer service and relies on Tecnotree technology to improve the customer experience.

- Andrés Reinoso Cifuentes

- Manager, Movistar (Ecuador)

With the new my.t Selfcare, we’ve taken a great leap in our digital journey, the application will help our customers by bringing our products and services right at their fingertips. The contribution and dedication of Tecnotree team to help us achieve our goals has been worthy of special praise.

- Virendra Kumar Bissoounauth

- CIO, Mauritius Telecom

We are delighted to work with Tecnotree as the strategic partner to implement a Digital BSS stack as part of our BRIGHT strategy. Tecnotree, our long-standing partner in this journey, will help us transform our current BSS stack to a digitally enabled modern platform that will help us deliver these services in a faster and agile way.

- Charles Molapisi

- CTIO, MTN Group (Africa)

Cyta has been a partner with Tecnotree since 1997 (Tecnomen at that time), using the Tecnotree Voice Mail System (VMS). The system and service are proved to be very stable and the solution robust. It helped us to optimize significantly operations costs and to maintain the revenues of the service in the challenging environment. We also value high the daily support we are receiving from Tecnotree’s responsive European technical team.

- Marios Scottis

- VAS Team Leader, Cyta (Cyprus)

Get Started Now

Sign up for a product that best suits your need

It is quick, easy, and simple